________________________________________________________________________________________________________________________________________

________________________________________________________________________________________________________________________________________

| Business Tech Energy Health Finance Economy |

______________________________________________________________________________________________ Advertisement ________________________________________________________________________________________________________________________ Berkshire Hathaway Ensures Diversification Tweet from CNNMoney stock market editor. One of a few tweets likening Google's move to Berkshire Hathaway AUGUST 13, 2015 Soon after Google (GOOGL) announced plans to form an overarching parent company named Alphabet, several journalists drew comparisons to Berkshire Hathaway (BRK-A, BRK-B). Since 2010 Google and Berkshire Hathaway's stocks have traded at similar market caps and increased at a similar pace, with rankings of the top most valuable companies listing Berkshire third and Google fourth in the first quarter of 2015. Google sprinted ahead of Berkshire Hathaway recently, taking an approximate $100B lead. In their announcement Alphabet leadership pointed to diverse operations (see the line placed in bold below) as one reason for change:

There are some differences between Alphabet and Berkshire Hathaway at this point. However, there are also similiarities. For instance in an average day people encounter products and services from both these companies. Berkshire Hathaway, for such a large company, is surprisingly simple thanks to strong principle and business model that is focused on a sense for profitability. Berkshire Hathaway and Google are strong forces in their respective industries. Berkshire Hathaway draws from a more established world of business: Insurance, finance, grocery supply, popular candy, fast-food, underwear, jewlery, vehicle services and so on. What remains to be seen is whether Alphabet will acheive the same success. This article will focus on Berkshire Hathaway and particularly the acquisition of Precision Castparts. Please note, this article will refer to Precision Castparts as "Precision" at times, because it's not like there's another metal company out there named Precision. Even if there were, it's not like they're owned by the same company, and on the off chance it turns out there are, this article will use "Precision" to refer to the one worth about $37B. Berkshire's Acquisitions Take a look at a few of the investments leading up to the acquisition of Berkshire Hathaway. Remember part of Berkshire's model is to simultaneously invest in and own companies in what could be considered key areas. Here are a few highlights of Berkshire's portfolio:

Marmon acquired Union Tank Car in 1981, as part of TransUnion Credit Union (originally formed to hold Union Tank) Marmon spun TransUnion off in '05

Berkshire's Investments

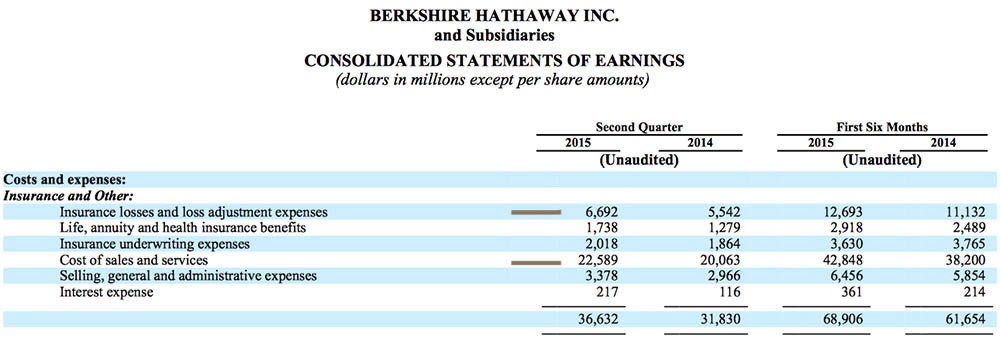

So, a pattern that emerges is investment in historic, proven businesses. Additionally the networking of a few investors' preferences, working in conjunction with the guidance of Berkshire's leadership. DaVita Healthcare being a primary instance. Another pattern is the intersection of ideals with profitability, with the supposed potential for Berkshire to increase efficiency through years of experience. Berkshire obviously does not have a so-called Midas Touch, the textile business did not exactly blossom into fruition. However, what Berkshire did right was diversify, it appears. Acquisitions Ensuring Diversification Before news broke of the Precision Castparts acquisition, the focus of Berkshire's Q2 earnings release was a drop in profits. Berkshire Hathaway profits were dragged down, by larger insurance losses and greater cost of sales & services, as presented in this extract:

In this sense Berkshire Hathaway's business is tied to natural phenomenon. For example heavy flooding across the United States during the summer could have impacted some of Berkshire's insurance businesses. In addition to these expenses, Berkshire reported $2.3B investment gain in Q2 2014 and $136M in Q2 2015. The insurance business' sales and service revenue went up $2.9B, still not enough to balance the cumulative effect of greater costs, expenses and much lower investment gains. While Berkshire's finance & financial products segment reported a $226M investment gain in Q2 2015, compared to no investment gain in Q2 2014, there was also a ($174M) derivatives loss compared to a $155M derivatives gain in Q2 2014. The first 6 months of 2015 still boasts a much larger $1.1B derivatives gain compared to $391M derivatives gain for the first 6 months of 2014. Berkshire Hathaway finalized a moderate sized automotive dealership acquisition: Van Tuyl Group (announced in October 2014.) Between Van Tuyl and regulated electric transmission company AltaLink, Berkshire reported acquisition expenses of $6.8B.

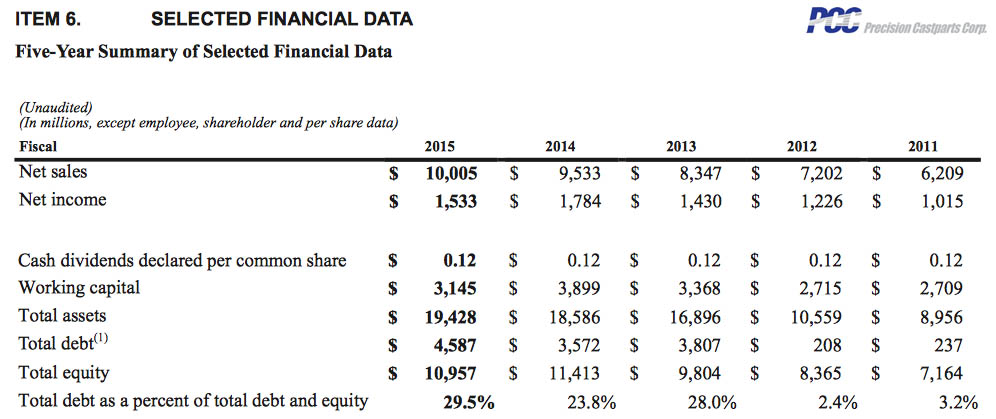

Source: berkshirehathawayautomotive.com (formerly VanTuylGroup.com) Van Tuyl established 81 dealerships and appears to have saturated many of their markets. There are several locations in Florida, Western Missouri, Eastern Nebraska, Texas, Arizona, San Francisco and Los Angeles. With single locations in southwestern Indiana, central Illinois and New Mexico. The Business Of Owning Businesses Take a look at Precision Castparts most recent annual report, for an idea of what may have appealed to Berkshire:  Berkshire did not walk into the deal from the cold, they built up a position to begin with, though it was recent. Precision's market cap went from approximately $1B in the late 1990s to $3.4B in 2004, then brokeout between 2010-2015, stabilizing around $15.6B in 2010. Precision Castparts experienced hypergrowth in the past 10 years, and all the while implemented an acquisition strategy. Here is Precision Castparts map of business locations:

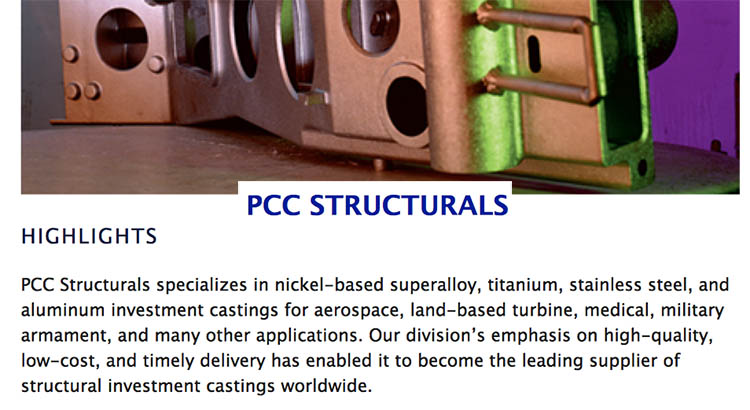

Soure: Precision Castparts Locations Precision appears to have a strong global presence and caters to larger businesses like General Electric (GE). While Precision mentions potential competition in their annual report, from the likes of Alcoa (AA), currently Precision states they have taken the lead, as the snapshot above states:

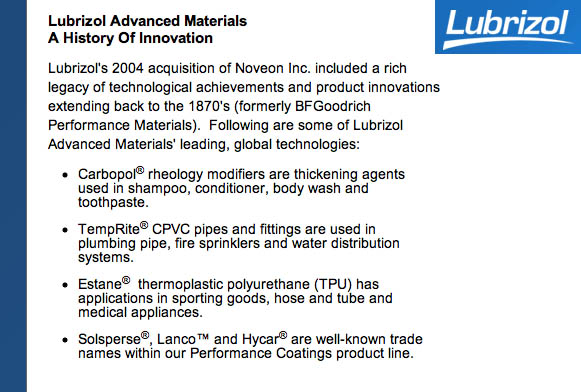

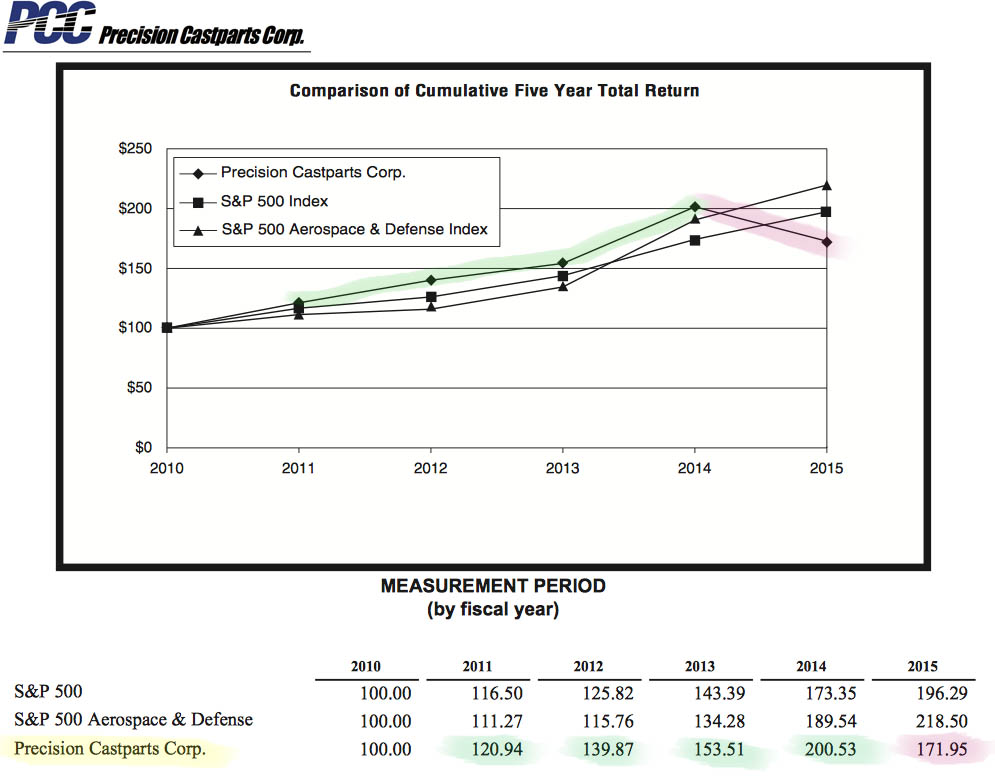

Precision Castparts appears to further Berkshire's interest in businesses that serve business. Lubrizol and BNSF Railway share similar traits. Whereas Berkshire partnered with other companies on deals like Wrigley, Heinz, and Kraft. Those companies focus more on brands recognizable to average consumers, than companies like: BNSF, Lubrizol and Precision Castparts' brands familiar to business leaders. Berkshire picked Precision up on a dip and the remaining question is whether the former upward trend will return?  Source: Precision Castparts Investor Relations, 2015 Annual Report Of course Berkshire is in a unique position to afford integrating Precision over the long-term. Between Van Tuyl Automotive (now Berkshire Hathaway Automotive) and Precision, Berkshire's annual revenue could increase approximately $19B. With Precision reporting $10B for the previous year and Van Tuyl's current annual revenue estimated around $9B. Precision reported $2.6B EBITDA compared to Van Tuyl's estimated $350M earnings before taxes. Precision Castparts is labor intensive, and relies on global metal prices and international production. Also of note, miners have struggled in recent years. For instance, on August 11, 2015 Rio de Janeiro based Vale SA (VALE) dropped 5.67%, Melbourne based BHP Billiton (BHP) dropped 4.78% and London based Rio Tinto plc (RIO) dropped 3.68%. While companies like Pittsburgh based U.S. Steel (X) dropped 8.93% on August 11th, and New York City based Alcoa dropped 5.95%; Luxembourg based Arcelor Mittal (MT), the top producer of steel, dropped 4.64%. With Alcoa, BHP, Vale and Rio Tinto staging slight recoveries on August 12th. While United Steel and Arcelor Mittal added to their stock losses. The Business Of Making Materials More Valuable The difference between the miners and Precision Castparts is: Precision uses materials to produce parts necessary for products with more value. Comparatively several of Berkshire's successful companies work on similar advancements of basic materials; making chocolate, for instance more valuable. Keep in mind Precision Castparts' annual net income was an average of $1.57B for the past 3 years.

Soure: Precision Castparts Notice the materials: "Nickel-based superalloy, titanium, stainless steel and aluminum." Given the fact the U.S. dollar has performed well recently, compared to several top metal producing nations' currencies, there could be an added advantage. Take a look at one of Precision's segments focusing on titanium. In 2012 Precision paid approximately $2.9B for TIMET:

Soure: Precision Castparts TIMET is now a part of PCC Forged Products. The company has a long history, a major presence in its field and is a global business. Precision Castparts also made a $721M acquisition of Wyman Gordon in 1999 and acquired Fatigue Technologies in 2008. Additionally Precision Castparts bought Permaswage from Bridgepoint Capital in 2013 for $600M. Here is Permaswage's business summary, on their website:  Permaswage, Wyman Gordon and Fatigue Technologies have all won contracts for major aerospace products like the F-35. Potential for similar large contracts, in the future, are added reasons Precision may have been attractive to Berkshire. As they perhaps attempted to further diversify operations. As the name of the company implies "precision" and quality are fundamentally important in this area of business. Take for instance the fact the F-35 production was suspended for a short time recently, due to what was believed to be faulty titanium products. Here is an extract from an opinion from Flight Global:

This illustrates some of the complexities Precision must balance. Berkshire's 13-F filing from March 2015 showed 47 stock holdings, including Precision. Precision was the 16th top holding according to dollar value, at $882M. There was also a 47% increase in the position. According to Berkshire's holdings, Deere & Company (DE) ranked 13th in their portfolio. Here is an article republished by Yahoo! Finance detailing Berkshire's recent investment in Deere. Deere has a market cap of approximately $32B and annual revenue around $36B. Deere averaged $3.25B net income for the past 3 years. Deere's Q2 2015 earnings stated:

Deere's revenue is 3 times Precision's and annual net income is double. Their respective market caps are also in a similar range. Deere reported stronger performance in '13 than in '12, however weakened somewhat in '14, like Precision. Since February 2009 Deere and Precision both recovered nicely, additionally Deere pays a reasonable 2.5% dividend compared to Precision's 0.10%. Precision did lift off compared to Deere's flatter performance since May 2011. However, Deere quite simply made far more profit. Also consider the fact Precision's annual 0.12 cent dividend paid $504k a year on 4.2M shares ($882M total position before the acquisition.) Compared to Berkshire's larger position in Deere: 17.3M shares collects approximately $41.5M in dividends (on Berkshire's $1.5B Deere investment.) Will S&P Downgrade Berkshire's Credit Rating? Clearly Precision Castparts realized an impressive growth trend in the past few years. An important characteristic to consider is Precision accomplished this on their own. So, expectations are they have the potential to continue the trend. Few companies are in a position to accomplish the deal Berkshire has engaged in with Precision. Even fewer could, as part of an even larger acquisition strategy. Though S&P is currently reviewing Berkshire's rating and some reports indicate they are considering a downgrade, due to the Precision acquisition. S&P rated Precision Castparts' corporate debt A- before the Berkshire deal and rates Berkshire corporate debt AA. Precision reported $678M in pension and other post-retirement expenses in their 2015 annual report. Additionally the report stated:

Precision reported $4.77B in long-term debt, that Berkshire plans to take on. In addition to Berkshire's present debt of approximately $84.59B (including $20.9B from BNSF due between 2015-2097) compared to Berkshire's cash & equivalents at the end of the second quarter of $66.5B, up from $55.4B at the end of Q2 2014. So, minus $37B the cash position potentially could go to $29.5B and the debt could go to approximately $90B. One clue to Berkshire's philosophy can be found in their 2014 report, where leadership wrote:

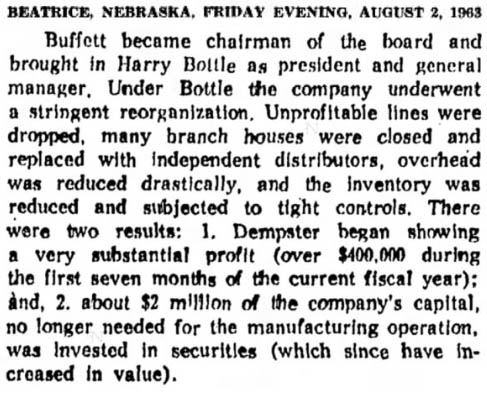

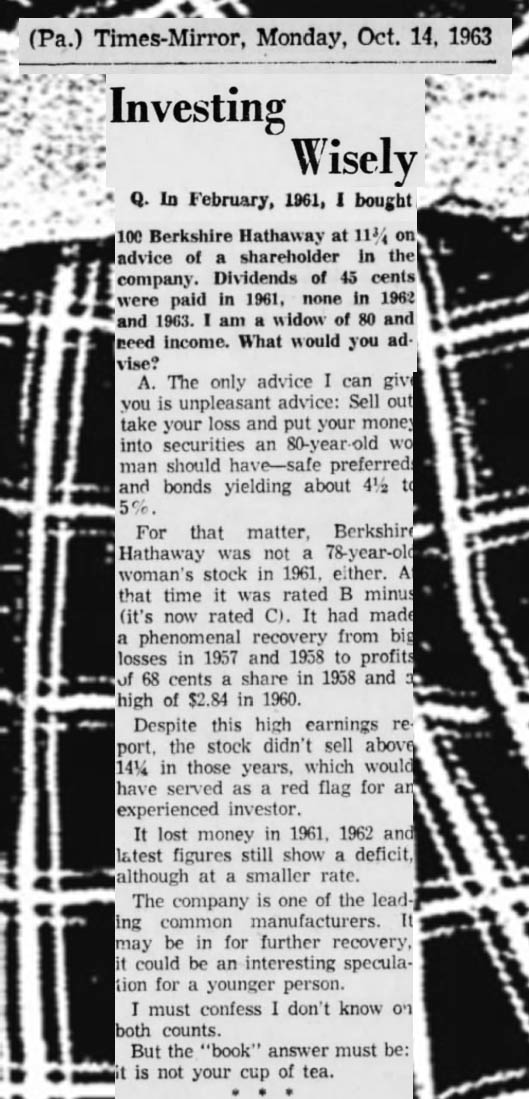

To a degree the acquisition strategy hinges on whether Precision can not just sustain; build momentum. Whereas BNSF was more specific to the U.S., Precision goes global. The Bottom Line Critically, the two arguments that could be made are Berkshire paid too much and would have potentially seen more near-term profit if they bought Deere. Though, clearly, Berkshire makes moves based on the perception of value. Whereas a concept many years ago was agriculture based economy for instance, Berkshire draws business from business and is distinctly focused on insurance, finance, consumer goods and transportation. If the argument against Berkshire's extension of business is that insurance underperformed during a season with heavy flooding, then the counter argument is: Deals like Van Tuyl and Precision diversify Berkshire's foundation, as BNSF did. The purpose of this article is not to agree with or disagree with Berkshire's acquisition. Only to state what seems important in the aftermath: Precision Castparts' performance and capacity to offer diversification. Berkshire's business model succeeds because of a strong principle and sense for profitability. Additionally acquisition strategy, though Berkshire Hathaway leaders have lamented the original purchase of the textile company in the mid 1960s, they did trace their origins to the American Industrial Revolution. At the time Buffett Limited Partners purchased Berkshire Hathaway, some strategists recommended selling:  The opinion from 1963 may have accounted for several important factors, and even under the leadership of Buffett Limited Partners, Berkshire Hathaway encountered difficulties. Simply because of competition and quality of materials that were unforeseen. Though, as it turns out 100 shares of Berkshire Hathaway for $11.75 a share was probably a good deal. Both Berkshire and Alphabet are powerhouses and are dependent on leadership that does not deter from business principle and sense for profitability. It is worth repeating, Berkshire's portfolio of investments is focused; holding 47 stocks. Rather than walking into Precision cold, Berkshire allowed some time to see how Precision works and to judge performance, relative to a few large core investments. Google made approximately 182 acquisitions before introducing Alphabet. DoubleClick, Motorola Mobility and Nest Labs (home automation) were some of the larger purchases. Google paid $12.5B for Motorola Mobility in 2012, kept approximately 2,000 patents and sold the remaining Motorola Mobility assets for $2.9B to Lenova in 2014. (source: Wikipedia, Motorola Mobility) Whereas DoubleClick was a keeper, Google was able to extract the parts it wanted from Motorola Mobility. So, it is important to emphasize, the world of mergers and acquisitions is complex and often some areas of the businesses succeed while others do not. This makes acquisitions made by an experienced force like Berkshire all the more important, given they can afford to be precise. Berkshire's 1990 annual letter points to their 1984 letter:

Though, relative to acquisitions this excerpt from Berkshire's 1984 annual letter stands out:

Clearly success, simply depends on decision making that places the best interest of the business at the forefront. If that is what Berkshire intended with Precision, then there appears to be more of a chance of success. If that is what Alphabet intends with their new design, perhaps their chance of success increases, relative to their business. Since there is always risk. Berkshire's 1990 letter addresses this with a reference to one of Benjamin Graham's mottos:

Berkshire has experience with smaller metal companies like Precision Steel Warehouse (the smaller, unrelated business acquired by Marmon in 1979) and Iscar. The Precision deal certainly appears to have the potential to make Berkshire more powerful. In reference to the 1992 acquisition of Central States Indemnity, Berkshire's annual letter offered some wisdom that seems relevant to the Precision acquisition:

This quote seems related since the Precision deal appears designed to forge more permanence. Precision expands Berkshire's product and service offerings. Though modern tech companies are simply not in the same business as Berkshire, one important consideration is: Berkshire's business model alone does not automatically produce success. In addition to business principle and sense for profitability, it is the balance of diversification that allowed a historic textile business to actually close; yet continue to grow into one of the most valuable companies in the world. *Note: This article is corrected to reflect Precision Castparts' $0.12 annual dividend, instead of $0.10 cent dividend. Disclaimer: This article is not a recommendation to buy or sell. Mark Quarter Investment News authors hold Berkshire Hathaway stock and / or have exposure to Berkshire Hathaway & Precision Castparts and Google stock & bonds through funds. Please consult a qualified financial adviser to determine proper allocations, if any to investments. |

| Business Tech Energy Health Finance Economy |

© 2015