________________________________________________________________________________________________________________________________________

________________________________________________________________________________________________________________________________________

| Business Tech Energy Health Finance Economy |

______________________________________________________________________________________________ Advertisement ________________________________________________________________________________________________________________________ Apple & Google's Tale Of Two Quarters

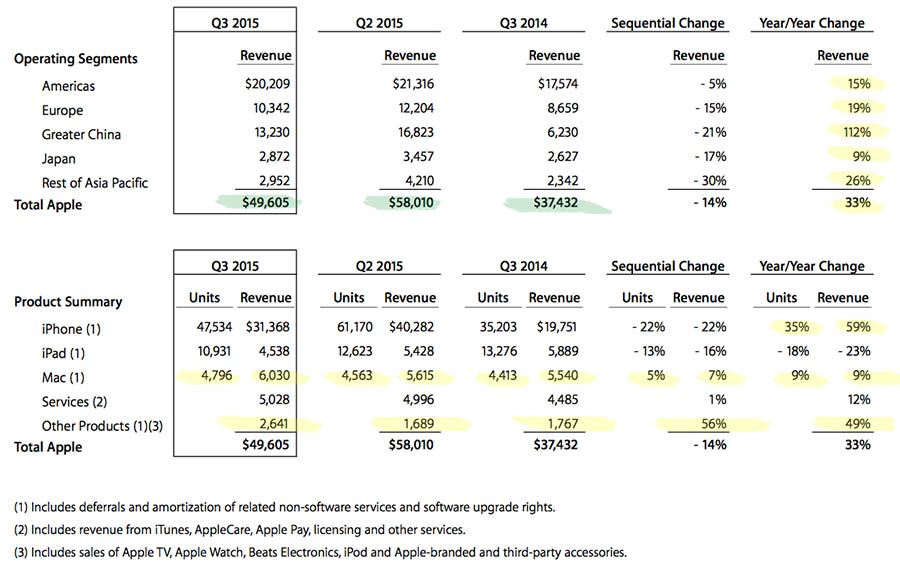

The new Apple Watch & Google Glass represent efforts to modernize old tech JULY 22, 2015 Apple (AAPL) stock price ran up before Q3 earnings, then took a dive after reporting on Tuesday July 21st. Shares traded down 8.3% to $120.33 before stabilizing, slightly, after-hours. With approximately 5.7B shares outstanding, amidst ongoing share buybacks, the $10.92 drop represented a market cap loss of around $60B dollars. During regular market hours on Wednesday July 22nd, Apple went as low as $121.99. Through trading the stock gained steam, closing down $5.53 at $125.22, a 4.23% loss. The important difference between Apple's drop and Google's (GOOGL) rise is that Apple stayed within a range, whereas Google soared to new heights. Apple traded at current levels all of a few days ago. Apple's Q3 Apple's Q3 report showed a 33% revenue increase from Q3 2014, with a 59% revenue increase from the iPhone and 35% increase in units sold since Q3 2014. The iPad however lagged from Q3 2014, while "other products" including the new Apple Watch showed a 49% revenue increase from Q3 2014 and 56% increase from Q2 2015:  Source: Apple Q3 report All operating segments by region gained revenue year/year, and all of them also saw decline sequentially from Q2 2015. Notice the Americas, Europe and Greater China declined less than their year/year gain. While Japan and Rest of Asia Pacific saw greater revenue decline sequentially than their year/year revenue gain. For instance: Revenue from Japam was up 9% from Q3 2014, but down 17% from Q2 2015. While revenue from Americas was up 15% from Q3 2014 and down 5% from Q2 2015. In this instance Japan and Rest of Asia Pacific were also two of Apple's smaller markets. Apple received some criticism for not detailing how many Apple Watches were sold. Though recent reports also indicated great satisfaction among owners of the Apple Watch, with some surveys stating 97% of customers are pleased with the product. Take a moment to review Apple's reported net income compared to Google's:

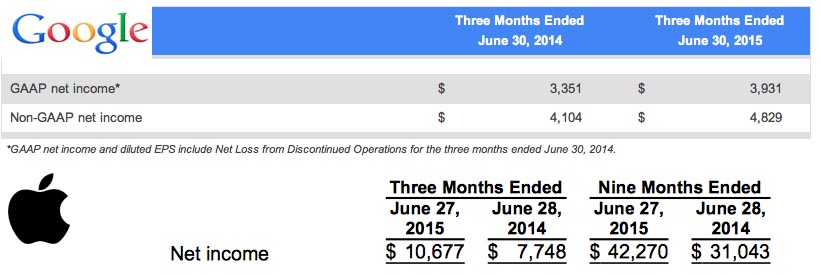

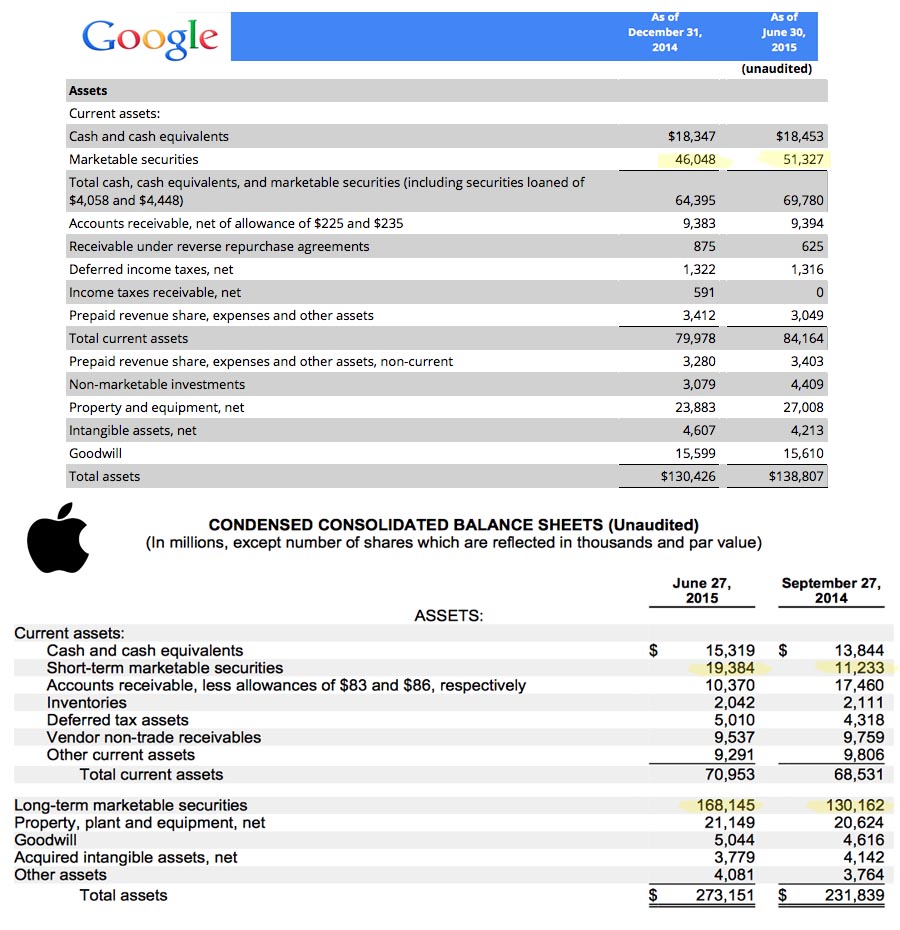

Source: Google Q2 report & Apple Q3 report Apple reported $10.6B net income for Q3 2015, a 37% increase from Q3 2014. Google reported GAAP net income of $3.9B, a 17% increase. Now check out Apple and Google's total assets, keep in mind Apple has taken on far more debt than Google, and also realize Apple has engaged in share buybacks, instituted a dividend and split their stock. Whereas Google recently created a new class of shares and split their stock, however does not have a dividend and is not buying back shares:

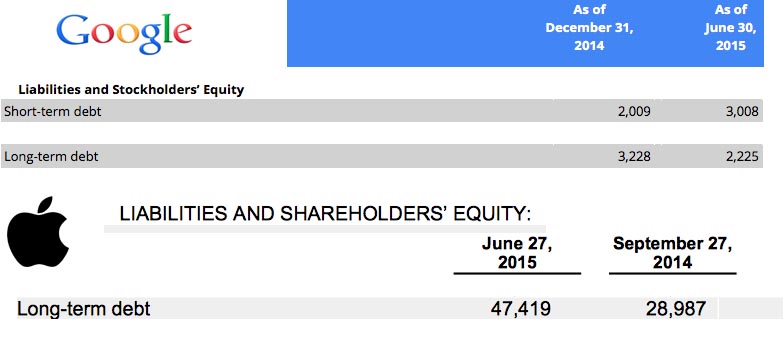

Source: Google's Q2 report & Apple's Q3 report Apple's short and long-term marketable securities rose $46.134B from September 27, 2014 to June 27, 2015. While long-term debt (Apple did not report short-term debt) went up $18.432B:  Source: Google's Q2 report & Apple's Q3 report Some factors to consider here are that Apple is in the business of product design in addition to software (including the newer Apple Pay service.) Google's business is centered on advertisement and websites, in addition to mobile operating and a variety of products like Google Glass and recent acquisitions of robotics companies and an endeavor to build self driving vehicles, in addition to mapping projects. Apple is a larger company and both companies' quarterly reports show growth and some fluctuation. Both companies' products are used by individuals and companies for business, education and recreation. Also neither company is "perfect." Some users have taken to Apple's App Store to complain about the new OS:  It is important to note there are as many 5-star reviews and several of the 1-star reviews center on disappointment with changes to Apple's photo software. Particularly the fact the upgrade removed existing libraries of photos. Some designers have been critical of the direction of Apple's programming.

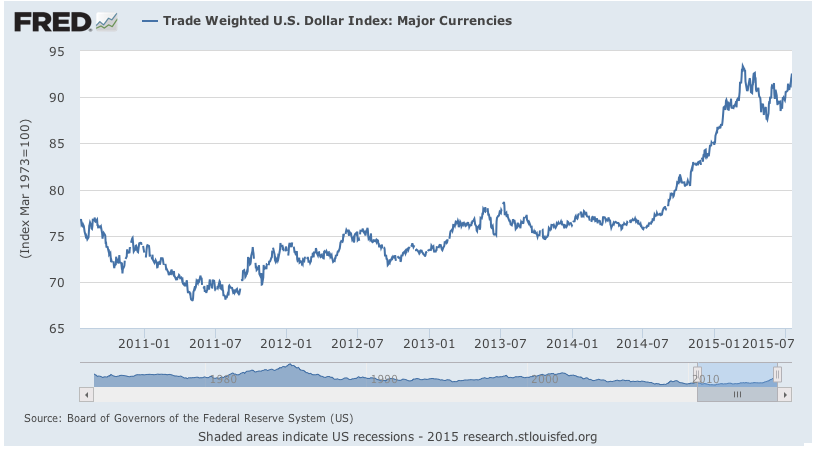

While the programmer whose blog was featured in the article published by PC Mag in January 2015 said he did not intend to be overly critical, these observations are relevant. Not to say Apple isn't a strong company, instead to note computer scientists and programmers hope to see the company maintain the level of excellence Apple was built on. Other criticisms include Apple's browser Safari (v 6.1.6) running on slightly older OS X 10.7.5, frequently freezes when the open-Apple-F "find" feature is used. Perhaps the greatest of them all however, is the auto-spell feature (that can not be deactivated) on the iPhone forcing to "correct" a word, to the wrong word. Investors for instance, who search stocks frequently, must retype their searches multiple times because the spell checker does not yet include those symbols. These examples include features that used to work fine, though when upgraded seem to have encountered a complication. As well as new features, like the auto-spell, that appear to have taken a while to be improved. One of the cores to Apple's brand is ease of use, this is a reason the company grew to where it is today. Investors should recognize that for each of the criticisms there appear to be numerous examples of Apple products and features that basically work flawlessly. However, it is important to understand criticisms in order to gauge improvements. Apple's Growth Relative To Trade Weighted U.S. Dollar Index Apple's Q3 report revealed strong year/year growth and net income growth. To put the revenue picture in perspective it may be insightful to cross reference the performance of the dollar recently:

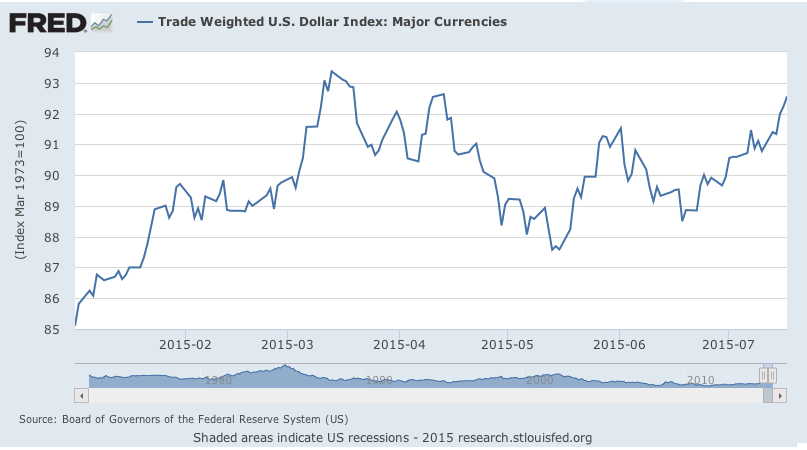

Source: St. Louis Fred, Economic Research Since last summer the dollar has gained considerable strength. Take a closer look at the past year, and notice the mid-April to mid-May decline (back to the level seen around January 2015) then the rise from mid-May to June, and so forth:  Source: St. Louis Fred, Economic Research Now take a look at the bigger picture:

Source: St. Louis Fred, Economic Research An important and simple take away from the trade weighted U.S. dollar index can be summed up with the popular quote: "The only constant is change." Based on the above graphs arguments can and will be made in both directions, in regard to the overall economy. This article's point is not to make predictions. The fact is markets fluctuate, and sure if all the moves could be predicted that'd be great. They can not though and investors encounter varying degrees of success and failure. This is why it does seem important to review the companies that outperform. From both an investment standpoint and business standpoint. One of the most important factors to consider here is competition. This is obvious to experienced businesspeople and investors, however may not be to some. If Apple announces a product it doesn't even take 24 hours for multiple other companies to have their versions in the works. To a large extent this is just the way the world of business is, and necessitates businesses outdo each other on quality. It is worth repeating: Especially within the world of technology one of the keys to success is ease of use. This goes to the basic logistics of consumerism: If a customer buys a product and it works well, and serves its purpose and they are a satisfied customer they are likely to maintain business with said company. On the contrary if a customer spends their money and feels it was wasted, they likely will not repeat business. It is incumbent upon the business to balance requirements of their products / services with the customers' and turn a profit. It appears Apple and Google thus far have struck this balance. Financial News Reaction To Apple Stock Decline Here are some article headlines that accompanied Apple's stock decline, after reporting Q3:

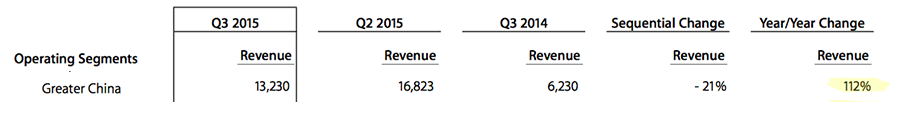

Source: Business Insider This article happens to standout because while Apple did report a 21% revenue decline from China since Q2 2015, the company's largest revenue increase year/year from Q3 2014 was from China:  In fact the revenue increase from China was 112% year/year. While other authors took the opportunity to publish articles like:

The Street Headline After Apple's Q3 Report Source: TheStreet Looking back to views by the same author from 2012 there seems to be similar pessimism:

The Street, "Real Money" Headline "Catching the Wave: Apple Teetering" Source: The Street, "Real Money" In fact, in the near term, Apple underperformed after The Street's article. However, in the longer term Apple did outperform. This is simply to say there are those who think the company will go up and those who think it will not. Bloomberg Business published "Why Apple Is Afraid To Reveal Watch Numbers":

Source: Bloomberg Business Twitter Channel Still Apple's Q3 report stated their "other products" including Beats, Apple TV and specifically Apple Watch generated a 49% revenue increase year/year and 56% revenue increase from Q2 2015. In several instances Apple has released new products and continued to constantly improve those products. While it is certainly fair and necessary to review performance critically, it is necessary to review coverage critically too. In this instance Bloomberg's tweet states: "Does Apple show weakness by failing to report sales of the Watch." The article's headline is:

Source: Bloomberg Business Twitter Channel Bloomberg's article poses some criticisms worth contemplating, while some criticisms posed appear contradictory and others appear unfounded. The other side of the coin here is that Apple took some time and developed a quality product. Both Apple and Google are large cap companies and they have faults, however it does not really appear that Apple Watch or Google Glass are those faults, whether they have underperformed, performed or outperformed. The faults appear to be things more like conditions at factories, and complaints from job applicants from both Apple (particularly Apple Stores) and Google. Google for instance has received a few complaints from applicants who believe they were not hired due to their age. One complaint from a tech worker alleges she was called by Google 4 times for interviews and rejected all 4 times, at first glance that seems excessive. Would it be nice for the world and investors if every single product was the next iPhone or the next Google.com? Sure, however keep in mind the time it took to design and build a telephone in the first place. Consider how long it took to have a watch or glasses for that matter. Quite frankly Apple and Google's calculative approach is impressive. This is simply to say some Apple investors are content with a 49% year/year revenue increase and 56% sequential quarterly increase on "other products." The Bottom Line Investors are constantly trying to determine value, and quite simply there is guesswork involved. Long-term investors in Apple and Google have done very well, particularly those who just bought and held. Both companies did not simply have it easy as the market fluctuated. The argument can be made that their respective experiences make them stronger today. What would be disappointing, given the fact that long-term Apple and Google investors benefited from ownership of companies run extraordinarily well, would be if Apple and Google had not made their new products: The Apple Watch and Google Glass. Though it is not guaranteed there will be future models, the old saying goes: "You have to start somewhere." The modernization of old tech devices has the potential to do precisely what the criticism within the Bloomberg View article is: "Apple has yet to come out with a life-changing new product." Given the nature of app design, the potential for these devices is actually unlimited. So it makes sense to allow Apple and Google some time to perfect the technology. Also to consider that $10.6B quarterly profit isn't so bad. Disclaimer: This article is not a recommendation to buy or sell. Mark Quarter Investment News authors hold Apple & Google stock and / or have exposure to Apple and Google stock & bonds through funds. Please consult a qualified financial adviser to determine proper allocations, if any to investments. |

| Business Tech Energy Health Finance Economy |

© 2015