________________________________________________________________________________________________________________________________________

________________________________________________________________________________________________________________________________________

| Business Tech Energy Health Finance Economy |

______________________________________________________________________________________________ Advertisement ________________________________________________________________________________________________________________________ Twitter Has What It Takes, But Must Set Self Apart

Soure: Internet Archive, Screen grab of Twitter profile in 2007 JULY 30, 2015 After a strong trading session on Tuesday July 28 Twitter (TWTR) released Q2 earnings that sent the stock flying. Midway into the earnings call Twitter stock did an about-face and spiraled into a nosedive.

Twitter's Intraday & After-hours Chart For July 28, 2015 (Source: Nasdaq.com)

On Wednesday Twitter was unable to rebound and closed down 14.5% to $31.24. Here are a few key points from the earnings release:

Detracting from favorable investor sentiment was the overall stock-based compensation scenario at Twitter:

For the 6 month period ending June 30, 2015 stock-based compensation was up $73M from 2014, to $357.9M. This represents a 25% increase. For perspective, Facebook (FB) reported Q2 share-based compensation jumped from $314M in Q2 2014 to $763M. However, Facebook revenue soared from $2.9B in Q2 2014 to $4B in Q2 2015, therefore $763M represents 18.8% of quarterly revenue for Facebook. Facebook also reported $719M quarterly net income whereas Twitter recorded a ($136M) quarterly loss. Looking back, Twitter's market cap sank below $18B in May 2014 and built back up to $35B in October 2014. Then fell to $23.5B by December 2014. These are major swings, by the way. All the way back up to $33B by April 2015 then fell dramatically.

That 25% dive coincided with their TellApart acquisition. Twitter's earnings call glanced over TellApart at first then spoke at lenth in response to questions. Before looking at Twitter's statements let's review TellApart's client list:  The important question on investors' minds is: Was TellApart worth 12.6M shares of Twitter? This is what Twitter said about TellApart in their earnings call:

Deutsche Bank asked:

Twitter responded:

Further into the call JPMorgan (JPM) asked:

Twitter responded:

Twitter also commented:

Bank of Montreal Capital Markets asked:

Twitter concluded the call with their response BMO's question:

Twitter presented their case, however investors reacted with disappointment. Reasons could be uncertainty and the effect of dilution. However, according to Twitter's statements the company appears to believe they have boosted one of their fastest growing advertisement areas. Was TellApart Overpriced? In Q2 Twitter stated $458M common stock was issued in connection with aquisitions. The company also purchased an artificial intelligence firm in Q2: Whetlab (machine learning.) Though the TellApart deal was the big one.  Source: TellApart's Announcement of Acquistion by Twitter Twitter agreed to issue TellApart owners 12.6M shares of stock, at the time priced at $42.27 a share. It's one of those tricky issues in the investment world, for a new company like Twitter to use stock this way. Basically investors don't like to cross their fingers, so clear explanation as to logic makes sense and in their call Twitter does appear to voice explanation, however it may not be the assurance investors wanted. Additionally investors' shares appear to be continually diluted. With guidance suggesting an increased rate of stock-based compensation, regardless of performance. This is the key: Performance. Not just linked to revenue growth, linked to net income. The AdExchanger reported:

Source: adexchanger One hitch is: At the time of acquisition Dick Costolo was both CEO of Twitter and one of a few "angel investors" in TellApart. In this instance the difference between "net revenue at $50 million to $100 million" is an important distinction. Barron's Tech Trader Daily published "Twitter's Latest Upset: Paying $533M For TellApart and Not Disclosing" cited an analysis that went with $100M, however it is simply the guessing game that is the cause for confusion. To the point a top concern is simply whether TellApart was in the best interest of all Twitter investors or was it in the best interest of TellApart investors? It is worth noting Mr. Costolo did a great job picking Twitter, when he made a large $5M investment in the company in 2010. Another question is: How much will Twitter continue to dilute shares for the rest of investors? Twitter reported GAAP and non-GAAP statistics and excluded stock-based compensation from non-GAAP with a note:

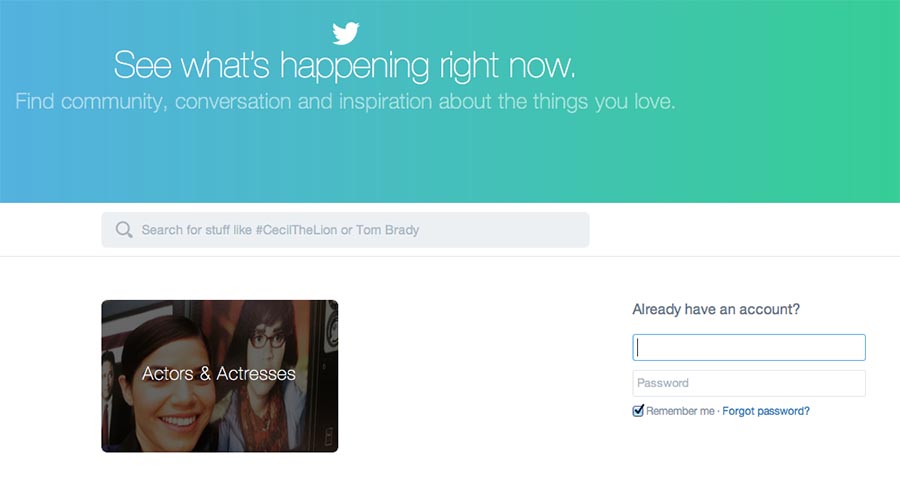

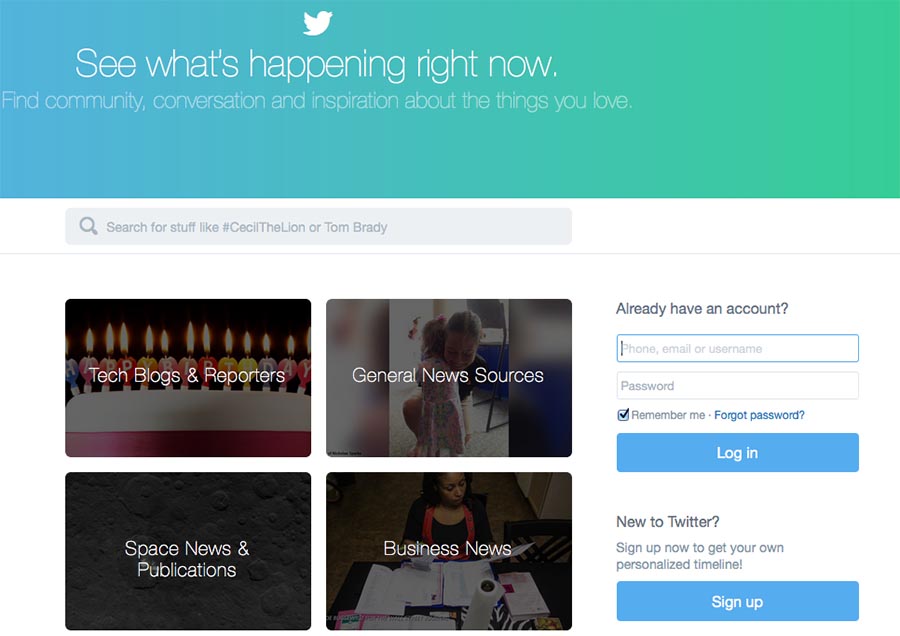

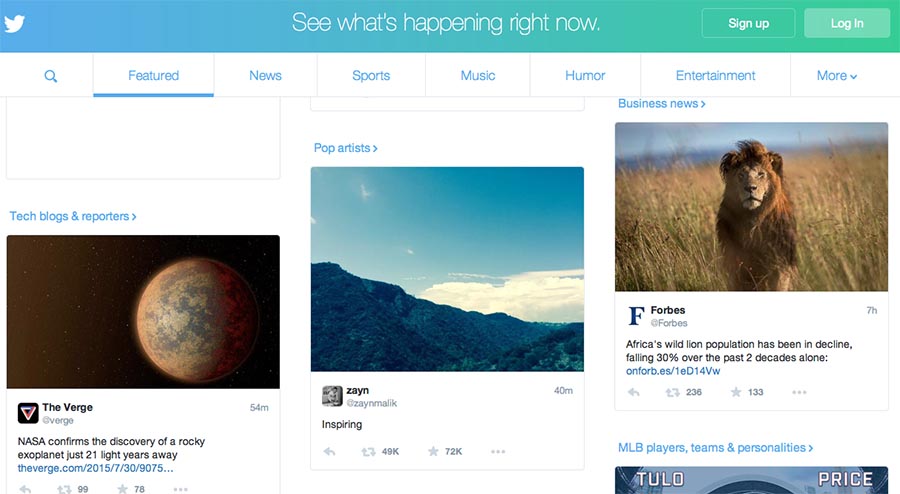

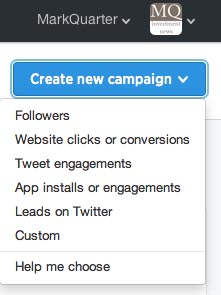

This non-GAAP method is similar to competing companies, like Facebook's reporting by the way. As one reporter published during Twitter's earnings call:  Source: Marketwatch What's more, including the large acqusition of TellApart the issuance of stock is not just 35% of revenue, it exceeds quarterly revenue. If the acquisition turns out to be strong then investors might not need to worry, except for the fact their position was diluted and is projected to be diluted more. If Twitter is vastly undervalued at this point, then "no worries." Twitter: Simple Improvement In Order Washington Post recently reported on Twitter pre-earnings and centered on a "frat-themed party" the company threw, amid criticisms the company is not diverse. This article will glance over the subject of equal pay and diversity at Twitter, only because the main reason for citing the Washington Post article is the phrase "growing up" in regards to Twitter on the whole:  Source: Washington Post It is interesting to note: Of the top 25 Twitter accounts, by number of followers, 21 are attributed to people and 4 are attributed to organizations (@YouTube, @Twitter, @instagram & @cnnbrk). Of the 21 channels attributed to people 14 are women, or 66%. Given the fact men make more than women on average the economy is influenced accordingly. However, it is worth noting: If any platform can be the catalyst for change on this mattter, it is Twitter. So, does Twitter really need to grow up? From an investor standpoint this suggestion raises questions. This article takes the perspective that rather than "grow up" Twitter should realize their potential, and set a consistent standard. The intelligent recommendation appears to be Twitter should do everything within their power to preserve success and popularity, no matter what (within reason.) This does not mean Twitter should not be a diverse workplace. To the point: Twitter should realize their potential, and set a consistent standard. On Twitter's IPO their CEO, Mr. Costolo gave the impression shares of the company were being regarded as having long-term value. The question remains: Is all of the dilution of Twitter shares in keeping with this sentiment? For instance, did Twitter really need to give 1.5M shares to their new CFO, who was previously a Goldman (GS) exec who led Twitter's IPO? Was this performance-based and was it in keeping with a long-term value approach for the company? The hope is the decision was, however realistically at this point Twitter has underperformed. While a CFO can not overrule a CEO or a board, their thoughts have weight. So why wasn't Twitter's CFO speaking to investors' concerns of dilution and stock-based compensation in addition to, and related to the TellApart acquisition, during the earnings call? Why did the earnings release not devote more to TellApart if this was such a major component of the Q2 picture? A widely understood successful business tactic is the: earn your keep rule. So the point is definitely not to cast blame on one individual, as a matter of fact on the whole Twitter's employees have done something really great and investors should keep in mind Facebook nosedived also. Point here is to emphasize intelligent business practices, particularly performance-based initiatives that could have benefited a company in a similar position. Some People Like Twitter, Some Don't Basically Twitter does not work or appeal to people who "don't get the point of a tweet." They don't believe Twitter has value and don't understand why they, or anyone would be interested in a 140 character comment from them. They also, sure as anything, wouldn't want to maintain their page daily, weekly or even monthly. While those who do like Twitter see the site as very unique because Twitter happens, live. The succession of tweets create a stream of consciousness. Twitter could improve some techinal errors to uphold a consistent standard. The homepage of Twitter.com does not load properly on all web browsers, particularly slightly older models. Whereas YouTube loads:  Note, a similar update browser page may not be in Twitter's best interest. Because one interpretation is, if the browser is out of date "move along." Though YouTube does continue to work on the outdated browser. Twitter loads:  Here, instead of showing all of the categories Twitter loads one. When the mouse arrow scrolls over the category section they blink on and off. While this is using a slightly older model browser, Safari 6.1.6, and while computer manufacturers and web site designers are constantly updating and introducing new versions; Twitter presumably as a $20B company might want to maintain appearance, to those who are using slightly older models. This is what the homepage is supposed to look like:  This critique is secondary to the bigger issue of Twitter crashing. Twitter.com crashes the browser and only recently fixed the issue enough so users do not need to log back in. Twitter is more than qualified to test their site on both the newest operating systems and browsers, in addition to those that are a couple years old. Some users note the site crashes their browser a couple times a day. It is unclear if this is because of more advanced coding that Twitter is using, designed for the newer systems, or if it has to do with Twitter.com being overloaded. Before their IPO Twitter did semi-regularly reach capacity and load a page explaining their servers were maxing out. Since the IPO this problem appeared to be solved. Yet another version of the Twitter homepage that loads occasionally appears like this:  Some variety is actually nice, the user doesn't know what to expect. Though Twitter could simply do without the aforementioned apparent glitchy homepage. Twitter: Self-imposed Limitation Of Following 2,000 Accounts In terms of Twitter's self-imposed limitations, there are two major issues. One is the limit of how many accounts a user can follow. The limit is set at 2,000 and Twitter explains there is the possibilty of following more accounts depending on the ratio of followers to followed accounts. However, Twitter does not further explain the ratio and does not appear to set a length of time whereby the limit is eased. This is a major limitation to Twitter currently, because the barrier prevents those users who want to follow more from being able to do so. It does encourage users to choose wisely in filtering who they follow, however it also prevents other accounts from gaining followers. In addition this limitation causes accounts to lose followers, as users who follow 2,000 accounts go through and decide who to unfollow. Additionally when a user would like to follow back a new follower they may not be able to, if they've reached 2,000 without unfollowing other accounts. Ultimately, however if the account does not increase their own following their usage can plateau, and that can be negative for Twitter. On this same note, the second major issue expressed by Twitter users is that Twitter.com does not have a feature to see who has unfollowed. There are some third party apps designed to figure this out, however this is something Twitter might consider. Once a user has followed several accounts, or has gained several followers it is difficult to keep track of who has unfollowed. Some users only follow other users because they followed them. Additionally some Twitter users purposefully go through and follow accounts, to try to get a follow back (the term for when someone returns the favor and follows a recent follower.) However, some users then go and unfollow the people who followed them back. (Take a second to think about that, they followed you, you followed them back. All said and done right? {You might have even had to unfollow someone else to free up space to follow back} Then, they turn around and unfollow.) Twitter's limitation may prevent fake channels from mass following, to give the impression some channels are popular when they are not. However, the 2,000 follow rule limits real users who are genuinely interested in following many more accounts. This article isn't even going to go further on the "follow, follow back, unfollow phenomenon" because there is no possible argument for no unfollow notification, given the fact this maneuver exists. None. Advertising On Twitter  Twitter depends on advertising potential much like Google (GOOGL). One potential barrier to promoting a tweet in an ad campaign is the cost spent on tweet engagement rate (note it appears Twitter does not charge advertisers for impressions.) Impressions are views that do not include interactions like a favorite, retweet or follow. Impressions are also a major component of effective advertisement. For instance advertisements on television are all about impressions and work to generate interest in products or services. Tweet engagement rate on a Twitter ad campaign could appear low, depending on the success of the campaign. It should be noted Twitter's ad service is very customizable, and maximum bid for tweet engagement is recommended, however can be set by the advertiser.  Here are the different choices advertisers have for Twitter ad campaigns. Some businesses, however may not see the benefit of Twitter ads, if a campaign concludes with a low tweet engagement rate. Quite simply Twitter's advertisement software is very well constructed and easy to use. Advertisers can pick audiences they would like to promote their tweet to directly. Advertisers can choose to focus an ad campaign to a city, state or multiple states, or countries. One problem for Twitter is the fact some advertisers are a click from initiating a campaign, however decide not to because of second thoughts over price and effectiveness. Still Twitter appears to realize they must avoid inundating users or annoying them with ad overload. The challenge is a slippery slope, though quarterly revenue growth reported in Q2 2015 could be interpreted as promising. While Twitter appears to set certain thresholds for advertising parameters relative to user experience, one question is whether more affordable, larger reach ad campaigns (perhaps with added limitations) would increase usage? A tweet, that is not promoted, even from a channel with a small following can reach thousands of users, if the subject is trending. A small Twitter ad campaign can currently, also, reach a few thousand accounts; while a larger budget can reach more. Twitter could possibly break the ice with potential advertisers by offering larger reach deals that are within average budgets, for instance 100,000 unique user impressions for a set, affordable price. Beyond that Twitter could consider a 1M unique impression campaign. Though a deal on 1M might encroach on Twitter's standard for user experience, whereby too many ads can simply inundate those who use Twitter colloquially. Twitter Is A Window To The World This statement provided insight into one of Twitter's goals:

The important question Twitter must ask is whether change is worth it. Twitter is already on one course, and especially within social media, developers are constantly trying new things. In general some platforms (not specifically Twitter) fix things that were not broken and run the risk of losing momentum, if a change is not favored. Could be obvious changes or even underlying changes. For instance one recent tweet on the subject joked: "For each new feature, 5 existing features must be removed." Twitter has managed to blend additions, many times seamlessly and added features users like. For instance tweet analytics, whereby users can see how many views and clicks their tweet garnered, without going to analytics.twitter.com. While this article does take the stance Twitter is a strong social media venue, remember from an investment standpoint not only is a great product required, effective business strategy is as well. Twitter's emphasis on both event oriented advertising (Project Lightning) and TellApart have the markings of effective business strategy, however are yet unproven. The Bottom Line Twitter, on the whole could benefit from confidence that keeps shareholders' best interests in mind. Twitter's earnings call included criticism and to a degree lacked that sort of confidence. Some statements were confident, however, the objective reading of earnings lined up as they did, resulting in disappointment. Confidence is not a magic trick that turns a poor outlook into a good one during an earnings call. Instead it is the quality that is present from day one of the quarter through the earnings presentation and so forth. The confidence expressed in Twitter's earnings call appeared appropriate, even strong. However, the overall picture seems to lack concern for dilution and net income. Though it may not be what some want to hear: Net income is more important that stock-based compensation. Keep in mind Twitter reported 4,100 employees in Q2, Facebook reportedly surpassed 10,000 employees a few months ago. Facebook's market cap is approximately $267B, Twitter's is hovering around $20B. Even though Twitter stock got knocked down, the company has been at this level before. Make no mistake $20B is a lot; there are quality companies, worthy of investment, that have been around for a long time, demonstrate earnings growth and dividend growth that are no where near $20B. Twitter is currently, because of the fact a tech company on the web can be everywhere at once, all the time. Obviously this does not mean every tech company is automatically worth more than what it is worth. Investors in Twitter should review ads.twitter.com and if possible communicate with those who have used the service. What seems clear is that if a company wants to reach people on a popular social network, Twitter is designed to do that. Twitter could potentially break the ice and provide more incentive, however leadership has set a pace that is presumably mindful of user experience. In order for Twitter to succeed further, advertisers need to know their investment was worth it. The fundamental necessity is to break the ice with advertisers and Twitter users who would use Twitter Ads if the deal was good enough. So while a major event with a huge budget could consider Twitter's event oriented ad feature, so too could smaller local events wanting to boost attendance. IE: Simultaneous to Project Lightning, it would be interesting to see a type of "Local Lightning" geared for smaller groups, with deals good enough to appeal to smaller budgets, by increasing volume and properly presenting ads (which it does appear Twitter has a handle on) they can potentially be effective and not inundate or annoy. A smaller organization may only focus on one state or a smaller area, so a restriction to the better deal could be limited geographic audience. Though obviously event centered advertising, in many cases, may already focus on limited areas by nature, the restriction concept for better deals, for average budgets, is an example. To the point: A goal to consider is a deal whereby groups, both large and small, wouldn't give the choice to use Twitter Ads a second thought. Whereas currently some do and decide not to engage. Based on concern over how effective impressions are and cost of impressions versus potential for unpromoted tweets to reach a users' established base (rather than potential for expanding the base.) This is to say there is a lot of potential for Twitter Ads, for advertisers and for Twitter's community. There is more potential for Twitter to deliver content effectively and for advertisers to grow their businesses, by using Twitter Ads, if Twitter devises the right deals and maintains user experience. *Note: This article is corrected to reflect the fact Twitter Ads does not charge for impressions. Disclaimer: This article is not a recommendation to buy or sell. Mark Quarter Investment News authors hold Twitter stock and / or have exposure to Twitter through funds. Please consult a qualified financial adviser to determine proper allocations, if any to investments. |

| Business Tech Energy Health Finance Economy |

© 2015